With the rapid surge in esports popularity over the last decade, esports has proven to be a sound investment for forward-thinking bookmakers. Esports accounted for $560 million in revenues from wagering in 2019, and in 2018 esports was the fourth most popular sport measured in total amounts wagered for bookmaker Pinnacle, projected to move to a second place in 2020.

Still, bookmakers often express doubts about the viability of fully venturing into the esports market.

In this article, we will address some of the concerns we hear from bookmakers, and provide some suggestions on how to best approach esports.

Concerns

1. Video games come and go, which makes investments in esports too risky

One of the most common concerns we hear from bookmakers who consider entering esports is the short lifespan that game titles can have. After all, how can esports be profitable, when audiences constantly move to new games, making it almost impossible to follow the market?

When new video games are released, they often start out having an impressive number of fans and followers, only to see their viewership numbers decrease again soon after. As an example, Apex Legends was massively popular at launch in 2019 but lost much of its player and viewership share in less than a year. Another example is Heroes of the Storm which saw a massive investment in its esports scene from developer Blizzard in 2017 and 2018, but then abruptly had its esports funds cut only a month before the 2019 season started because the game was unable to reach the targeted audience numbers.

Since its release, Apex Legends’ viewership numbers have been decreasing rapidly.

These events does not mean that esports should avoided, but rather that a thorough evaluation of game titles should be performed before entering. Identifying the right games to cover is key for any bookmaker getting engaged in esports. First of all, games must have large audiences that have been loyal over time. Commercial interests, such as sponsorships, and investments into teams and organizers will also help game titles survive in the esports scene.

Based on these criteria, Counter-Strike : Global Offensive (CS:GO), League of Legends (LoL), and Dota2 seem to be the best bets for bookmakers right now. These games have been able to grow and maintain large audiences for many years, . Also, with huge investments from a wide range of major non-endemic brands like Mastercard, Louis Vuitton, and Manchester City, and with prize-pools as big as $34 million, they all have the track record and the financial foundation to guarantee future success.

2. Esports audience and players are too young

A common misconception among bookmakers is that the audience is too young to bet and that the professional esports athletes are underage, rendering it illegal to offer betting on matches in certain countries. As an example, Sweden has put in place regulations that penalise bookmakers featuring odds on sports where a majority of the players are under 18.

These regulations will, however, mainly affect battle royal games like Fortnite, Apex Legends, and Playerunknown’s Battlegrounds, that have a lot of underage players. In CS:GO, Dota2, and LoL, the vast majority of professional players are 18 or above, leaving only a proportion of matches infeasible for betting. This risk can be easily mitigated by subscribing to GameScorekeeper’s API or Player Age Report Email Service. The argument that the esports audience is mostly underage is a misconception as well. In fact, 73% of the audience is 20 years or older. Furthermore, the average income of the esports audience is higher than that of traditional sports fans, making it a lucrative audience to target.

3. With Germany and the US opening up for online sports betting, focusing on traditional sports makes more sense for us.

In light of recent legislation that allows bookmakers to offer online sports betting in Germany and a removal of the federal ban on sports betting in the US, many betting operators invest heavily in bringing traditional sports like soccer, baseball, football, and basketball to these markets rather than investing in esports. Although the potential in these new markets is substantial, there will be fierce competition, with both American and European betting operators vying to secure their positions.

It is, however, worth keeping in mind that an open sports betting market also implies a large esports betting opportunity in the same market. According to Deloitte, 9.2 million Germans watch esports regularly, while more than 40 million Americans watch esports and both numbers are growing rapidly. With huge audiences and the vast majority of bookmakers focusing on traditional sports, esports could be a great way into the German and US sports betting market.

4. Our customers are not interested in esports.

The lack of interest in esports among the current customer base is another common concern among bookmakers. After all, why should a bookmaker invest in esports, if their bettors have no interest in betting on it?

While many traditional punters have strong preferences towards a few selected sports, our market research shows that esports bettors stand out in this regard as they also bet on traditional sports besides esports. So, even if a bookmaker only has a limited number of current customers who are interested in esports, the future punters acquired through esports, are likely to be interested in your current offerings as well.

Also, even though esports is unlikely to be one of your biggest sportsbooks from the offset, having an offering will prepare you for the future, where it will be impossible for successful bookmakers to ignore esports. With a growing public interest in esports betting, a quality offering will, therefore, prevent current customers from changing to competitors.

5. The esports market is too immature to be profitable

In 2019 esports grew to become a billion-dollar industry, and with major investments and a growing audience with high spending power, perceived market immaturity should not be the discouraging factor that keeps bookmakers from getting engaged in esports. Actually, the fact that esports is not yet a fully mature market also means that it is not fully saturated yet. According to many of our clients, getting engaged with esports is easier compared to getting engaged with new traditional sports, where the competition is fiercer and where more actors fight over the same customers.

6. Match-fixing problems in esports pose a serious risk for bookmakers.

Just like any other sport reaching a certain level of popularity and interest, esports has had its share of problems with match-fixing. Match-fixing equals a loss of money for bookmakers and is often regarded as one of the biggest threats to the integrity of the esports industry. Therefore, the mission to curb and prevent fraud in esports has been a focus point for organisers, teams, industry organisations and investors in recent years.

The vast majority of event organisers have taken steps independently to address the situation by implementing regulations and fraud detection systems, that makes it harder to fix esports matches and new organisations such as ESIC are working to bring all relevant players in the industry together to secure integrity in esports.

Today, most esports events are monitored closely for match-fixing, just like traditional sports like soccer, basketball, tennis, and hockey. Although it will be impossible to rule out the risk of match-fixing completely, we believe that the efforts to suppress match-fixing will intensify, with continuing growth and maturation of the industry. With multi-million dollar prize pools, investments from well-known non-endemic brands, and a growing audience, there is a dogged determination in the industry to combat cheating and match-fixing. As a result, new rules and regulations are constantly being adopted, to preserve the integrity of esports.

7. With a myriad of tournaments and matches, a satisfying coverage of esports is impossible.

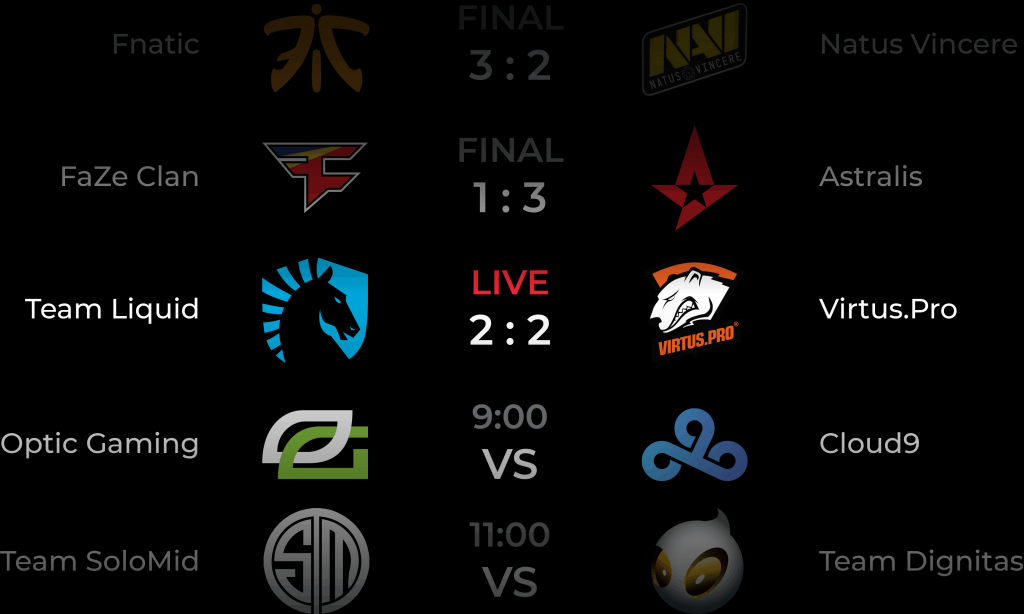

For bookmakers new to esports, a satisfactory coverage of the myriad of tournaments and matches can seem like a difficult task. It is, however, not impossible. The key is to find a data provider that has developed automated data collection systems to provide extensive coverage.

Using deep learning and computer vision, GameScorekeeper has automated its data collection process, allowing us to cover everything from World Championships, Majors and Internationals, to regional and amateur leagues. This enables bookmakers to cover every relevant match in CS: GO, LoL, and Dota2, which accounts for more than 85% of the total esports viewership.

Get in touch if you would like to hear more about our data coverage or data collection process.

8. Investing in esports is too expensive

For a bookmaker, adding any new sport to the offering is also a business case that should be evaluated thoroughly. Match scheduling and resulting, trading and risk management all needs to be addressed. Naturally, this is also the case for esports.

Still, it is possible to reduce the barrier of entry into esports.

Choosing the right data provider enables you to set up automated resulting and match scheduling. Also, by getting access to ready-made odds from an external partner, you can reduce the number of people needed on your trading team.

Contact us to find out more.

Getting engaged in Esports

As mentioned above, the misconceptions and doubts that bookmakers have about the esports market are for the most part overstated, and the market is definitely manageable.

With the current growth of the esports market, we believe that a quality esports offering will be essential for every successful bookmaker in the future. Without an esports offering, bookmakers risk missing out on an attractive and growing target group and risk losing clients to competitors.

The key is to enter the market correctly, and teaming up with the right data provider who can help you penetrate the market, deliver odds, and develop an engaging esports product, is vital.